In my previous article of Love & Affection Transfers, I have explained what is love and affection transfer, how to effect a love and affection transfer, as well as the exemptions of stamp duty for such transfers. The next question would be, is love and affection transfer also exempted from Real Property Gains Tax (RPGT)?

What is RPGT?

RPGT is a tax charged on gains arising from the disposal of properties or shares in real property companies (RPC). For the purpose of this article we only focus on the RPGT charged on gains arising from the disposal of properties.

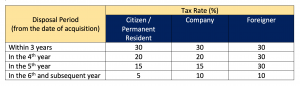

With effect from 1st January 2019, the revised RPGT rates for the disposal of property are as follows:

Is there any RPGT exemption for love and affection transfer?

The law provides for full exemption from having to pay RPGT in the case of a transfer of property by way of love and affection in the following instances:

(a) transfers between husband and wife;

(b) transfers between parent and child; and

(c) transfers between grandparent and grandchild.

In these instances, the transferor is deemed to have received no gain and suffered no loss and the transferee is deemed to have acquired the property at an acquisition price equal to the acquisition price paid by the transferor together with any permitted expenses incurred by the transferor.

That said, the transferor and transferee are not exempted from filing the relevant RPGT forms so don’t forget to submit all relevant forms and supporting documents to the IRB (LHDN) branch where the transferor’s income tax file is handled or nearest branch within 60 days of the transfer.

Conclusion

Parties to love and affection transfers are entitled to stamp duty and RPGT exemptions except for one awkward situation, i.e. there is no stamp duty exemption for the transfer of property by way of love and affection from a grandparent to his/her grandchild, but such transfer is exempted from RPGT.

Disclaimer:

The contents of this article is provided for general information and shall not constitute legal or other professional advice. Please contact us for further enquiry.